Real Salary Transparency: How to Evaluate a Compensation Claim in a Job Post

Salary is one of the most important factors in any job decision — yet it’s also one of the most misunderstood. Many job posts promise “competitive pay,” “market-leading salaries,” or “high earning potential” without offering any real clarity. In some cases, compensation figures are exaggerated, incomplete, or intentionally vague.

In an era where job scams and misleading listings are on the rise, salary transparency has become essential. This blog explains how candidates can critically evaluate compensation claims in job posts — and how verified platforms like JobsVerifier help bring honesty and clarity to salary information.

Why Salary Transparency Matters More Than Ever

A lack of salary transparency creates multiple problems for candidates:

- Wasted time applying to roles that don’t meet financial needs

- Unfair pay disparities between similar roles

- Mistrust toward employers and job boards

- Increased vulnerability to scams and misleading offers

For employers, unclear compensation can also backfire. Candidates who feel misled are more likely to decline offers, leave early, or share negative feedback publicly.

Transparent salary information builds trust, efficiency, and better hiring outcomes for both sides.

Common Salary Red Flags in Job Posts

Before applying, it’s important to recognize warning signs that a compensation claim may not be reliable.

1. Vague Language Without Numbers

Phrases like:

- “Attractive package”

- “Salary based on experience”

- “Unlimited earning potential”

are not necessarily dishonest — but when no range or structure is provided, it’s difficult to evaluate whether the role fits your expectations.

2. Unrealistically High Salaries

If a job promises pay significantly above industry norms without explaining why, it may be a red flag. These listings often rely on excitement rather than facts.

3. Commission-Heavy Roles Disguised as Fixed Pay

Some postings advertise a high monthly salary but fail to clarify that most of it is commission-based, performance-dependent, or conditional.

4. Missing Benefits Breakdown

True compensation includes more than base pay. When benefits like bonuses, insurance, equity, or overtime policies are omitted, the picture is incomplete.

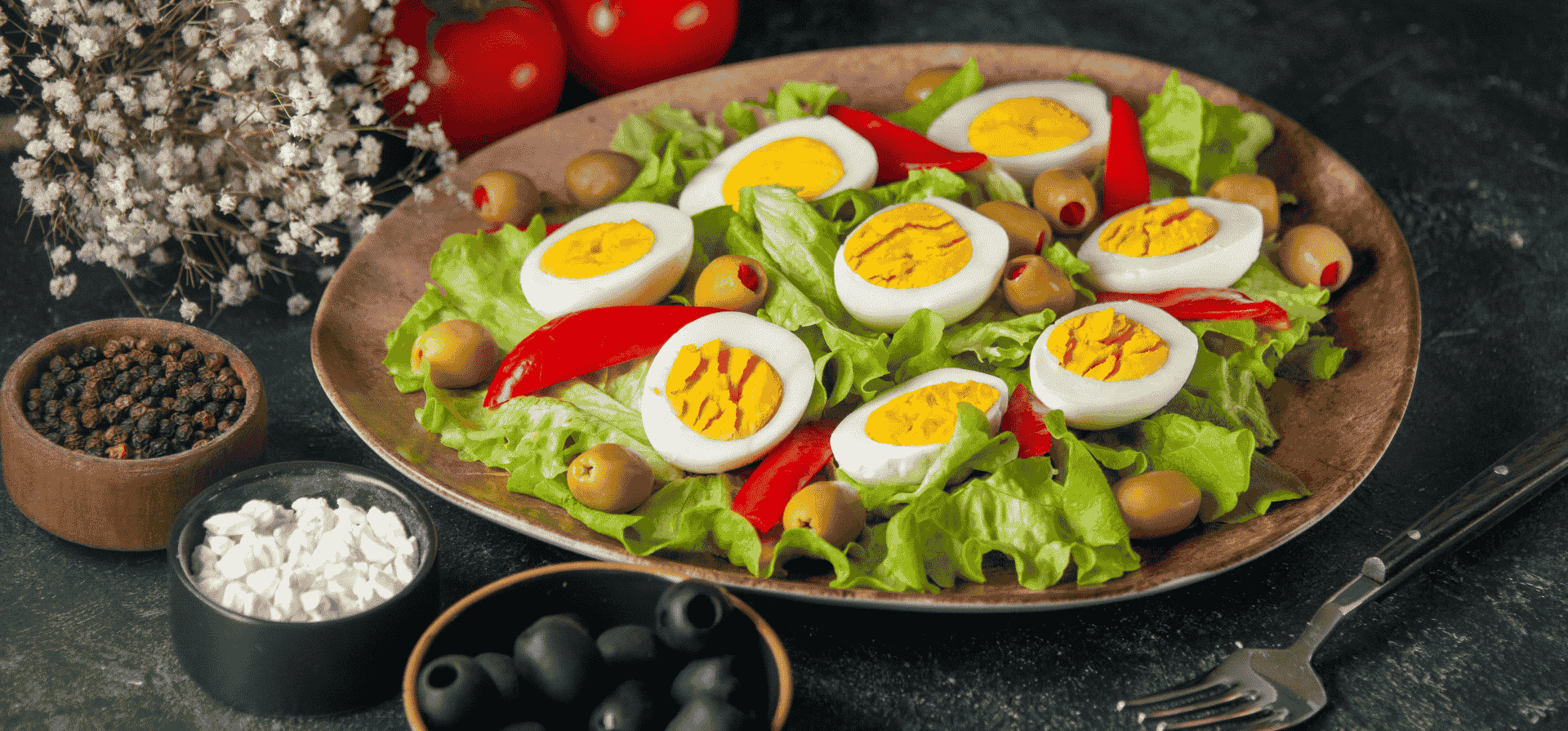

How to Evaluate a Compensation Claim Step by Step

Step 1: Compare With Market Benchmarks

Always compare the listed salary with:

- Industry averages

- Role-specific benchmarks

- Location-based pay standards

If a job claims to pay well above market rates, there should be a clear reason — such as niche skills, leadership responsibility, or performance incentives.

Step 2: Analyze the Role Scope

A higher salary should align with:

- Seniority level

- Required experience

- Technical or leadership complexity

If the responsibilities seem junior but the salary is senior-level, question the accuracy of the claim.

Step 3: Look for Salary Ranges, Not Single Numbers

A credible job post often includes a salary range, which indicates flexibility and honesty. Fixed numbers without explanation can sometimes be misleading or conditional.

Step 4: Check Payment Structure

Ask yourself:

- Is the salary monthly or annual?

- Is it gross or net?

- Does it include bonuses or commissions?

Clear posts define these details upfront.

Step 5: Research the Employer

Employer transparency often reflects compensation honesty. Check:

- Company size and funding

- Past employee reviews

- Employer history and reputation

Verified employers are far more likely to make realistic salary claims.

The Role of Verified Platforms in Salary Transparency

Traditional job boards often allow employers to post salaries without verification. This leads to inflated or misleading compensation claims staying live for months.

Verified platforms like JobsVerifier approach salary transparency differently.

Employer Verification

Before a job is published, the employer’s identity is checked. Verified employers are less likely to exaggerate pay because their credibility is attached to the listing.

Job Content Review

Salary information is reviewed for:

- Logical alignment with role responsibilities

- Consistency with industry norms

- Clarity in structure and expectations

Listings that appear misleading, vague, or unrealistic can be flagged or rejected.

Cross-Referencing With Market Data

Some verified platforms compare salary claims with:

- Similar verified roles

- Market averages

- Company size and location

This reduces the chance of unrealistic compensation promises.

Why Salary Transparency Protects Candidates

Transparent salary data helps candidates:

- Apply only to financially suitable roles

- Avoid exploitative or scam listings

- Negotiate more confidently

- Make informed career decisions

Instead of guessing or relying on vague promises, candidates can focus on opportunities that truly align with their goals.

How Employers Benefit From Transparent Salaries

Employers who disclose honest compensation information:

- Attract better-qualified candidates

- Reduce drop-off during interviews

- Build a strong employer brand

- Improve offer acceptance rates

Transparency filters out mismatched applicants early, saving time for both parties.

What Candidates Should Check Before Applying

Use this quick checklist when reviewing salary claims:

- Is a salary range clearly mentioned?

- Does the pay align with the role level?

- Are bonuses or commissions explained?

- Is the employer verified?

- Are benefits clearly outlined?

If multiple answers are unclear, proceed with caution.

The Future of Salary Transparency in Hiring

As job seekers demand more honesty and governments push for pay transparency laws, salary clarity will become the norm rather than the exception.

Platforms like JobsVerifier are already leading this shift by prioritizing verified employers, realistic compensation claims, and candidate trust.

In the future, salary transparency won’t just be a “nice to have” — it will be a requirement for credible hiring.

Conclusion

Salary transparency is no longer optional in a modern job market filled with misinformation and ghost listings. Evaluating compensation claims carefully — and relying on verified platforms — protects candidates from disappointment, wasted time, and unfair offers.

By choosing platforms that value verification, clarity, and trust, job seekers can apply with confidence and move closer to opportunities that genuinely reward their skills and experience.